Thought Waves

Tidal Ventures’ Grant McCarthy on navigating the Generative AI revolution

At Tidal Ventures, we use an ‘AI stack’ framework to structure our conversations. I’ll explain how we use it to frame our discussions around AI’s far-reaching investment implications, breaking down the layers that define this exciting technology field and exploring their investment opportunities.

23 Nov 2023 · 6 min read

Being in the technology space for over 20+ years, I rarely get excited about the latest ‘tech’ cycle—I’ve found that they’re often more ‘novel-hype’ than substance. But the current wave of AI innovation is different.

I can’t overstate how quickly generative AI is materially changing the world around us and the way we interact with hardware and software. For those of us who witnessed the rise of the internet in the late ’90s or the ubiquity of mobile devices in the 2010s, you’ll likely agree that generative AI has accelerated with a much more meteoric ascent.

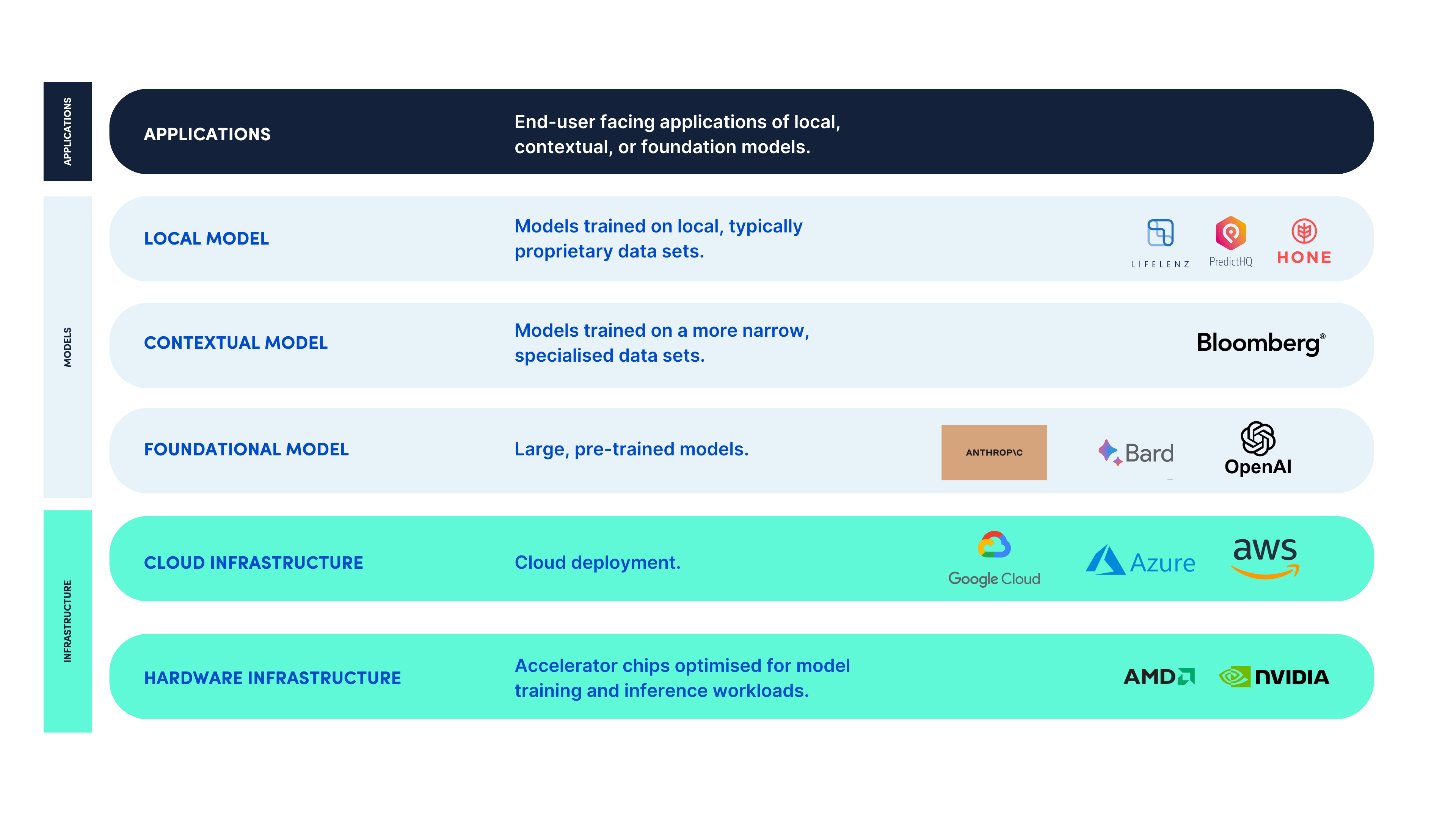

At Tidal Ventures, we use an ‘AI stack’ framework to structure our thinking and conversations. I’ll explain how we use it to frame our discussions around AI’s far-reaching investment implications, breaking down the layers that define this technology field and exploring their investment opportunities.

The AI stack

To effectively navigate the AI venture capital landscape, it’s crucial to understand the AI stack— which consists of three key layers: AI infrastructure, AI models, and AI applications.

AI infrastructure layer

At the base of the stack, you’ll find the infrastructure layer. This layer encompasses the essential hardware and cloud platforms that serve as the foundational building blocks upon which AI capabilities are constructed. It includes:

- Hardware infrastructure: Specialised accelerator chips optimised for model training and inference workloads.

- Cloud infrastructure: Comprising various cloud platforms that facilitate the large-scale computing required for AI-related operations.

AI models layer

The model layer plays a pivotal role in the AI landscape—these programs analyse datasets to find patterns and make predictions. The model layer encompasses:

- Foundational models are large, pre-trained models that serve as the base. Technologies like Google’s Bard and Meta’s Llama are crucial in bridging the gap between raw computing power and practical AI applications.

- Contextual models are trained on narrowed, industry-specific datasets. They are tailored to fulfil particular needs and act as the driving force behind various AI applications. Looks like BloombergGPT plans to do this for the finance world.

- Local models are trained on localised, often proprietary datasets, further refining AI’s capabilities for specific applications. LifeLenz and PredictHQ are key proprietary data sets within our portfolio.

AI applications layer

The application layer is at the top of the AI stack, where companies develop AI products and services for end-users (think Chat-GPT). These applications utilise local, contextual, and/or foundational models to provide a wide range of AI-powered solutions.

Tidal Ventures’ AI investment mindset

Tidal believes that the expanding and ubiquitous nature of cloud computing has quietly propelled multiple waves of technological innovation. As cloud technology continues to gain widespread adoption and the cost of computing resources continues to decrease, a transformative shift will not only continue but is set to accelerate. This shift will fuel the rapid expansion of artificial intelligence across diverse industries and applications, impacting the products and systems we use today in our everyday lives, both at work and at home.

Our focus, like always, is to find the very best product, engineering and commercial operators who have identified globally significant problems to solve. We look to zero in on these opportunities, which we’ve seen within Australia’s vibrant, innovative environment and beyond.

At Tidal Ventures, we’ve been investing in predictive AI for the past eight years. Our current portfolio includes companies that are revolutionising various sectors through AI, including:

- BuildBetter: Automating and improving efficiency within workflows, providing insightful summaries, and enhancing product and customer operations.

- FrankieOne: Enabling contextual payment processing and real-time fraud monitoring crucial for regulatory compliance.

- Hone: Using their cloud-based Machine Learning and AI to enable farmers to make real-time decisions on grain segregation, optimising quality, and yield values.

- LifeLenz: Using their proprietary AI-powered forecasting model to establish a global benchmark in labour scheduling.

- PredictHQ: Leveraging proprietary data for improving economic value and enhancing services like Uber’s surge pricing.

- Search.io: Enhancing customer conversion through personalisation and transforming the e-commerce landscape.

- TheLoops: Providing SupportOps to improve customer experience and boost revenue, leading to customer delight.

LLMs

Today’s tech conversations seem to centre around large language models (LLMs). It looks like the obvious way an LLM would or wouldn’t win is by nailing their distribution model. Ultimately, we’re seeing the race to which LLM will be used at scale because the more an LLM is used, the more data it accumulates, which propels its self-learning cycle.

When viewing technology in terms of where we should be investing, new LLMs aren’t the clear choice due to their intense capital requirements and competitive environments. The LLM arms race has been underway for nearly a decade, and we don’t see a specific path to investing early-stage capital in this segment. The one area that may be compelling is the open-source LLM category, which, while early, is showing solid traction. In any case, we’re keeping a close eye on the downstream impacts of LLMs and how they may impact the other layers we are keen to invest in.

Contextual and local models

While LLMs seem to be in the spotlight, we’ve been focused on investment opportunities in contextual and local models. These models leverage rich, industry or topic-specific data and create value around that data while layering it on top of core LLMs. As you can imagine, the contextual relevance of these models is incredibly powerful within specific industries (like wealth management). Of course, you have to define the data set and then get the AI to learn from that data set to create a valuable output for an application or system.

When it comes to AI—primary data, while interesting, is just a ‘feed-source’ for the models. What actually matters is the value one creates around the primary data and then applies to specific situations. This can become incredibly valuable economically and productivity-wise for the end users, making it an intriguing investment area. Consider PredictHQ (from our Seed I fund); they own the world’s best predictive data models around how events impact certain businesses’ demand. These insights can then be used to power pricing systems, labour scheduling, stock ordering, etc. Prominent tech players such as Google, Facebook, and Amazon have built their entire organisation’s revenue models on collecting and optimising their systems to meet customers’ desired advertising outcomes. They have benefited enormously from this. These new contextual models have the potential to do that for all businesses, not just the ‘big tech’ platforms. All of a sudden, proprietary data sets are back in vogue.

Built-for-purpose applications

In the current landscape, the application layer of AI technology is a hotbed of activity. Many individuals and organisations are fervently exploring strategies to capture the attention of particular audiences and entice them to adopt applications that leverage the immense power of AI.

While there will always be a place for general-purpose applications like ChatGPT, StabilityAI, or Midjourney, the prevailing trajectory in the AI landscape is towards specialised solutions tailored to distinct sectors, categories, or teams. As such, we’re keeping a close eye on the emerging built-for-purpose products that utilise foundational models, potentially layer on their local or contextual data, and make them accessible through various applications.

AI in Australia

I recently sat down with Ryan Black, Head of Policy and Research at the Tech Council of Australia, to frame the local opportunity.

Ryan and I both agree that Australia’s power in the global AI ecosystem will undoubtedly lie in the application layer, particularly in generative AI. While it may not be at the forefront of developing foundational AI models or semiconductors, the country’s strengths in product and software development, cloud computing, and software as a service (SaaS) make it well-suited to harness AI’s potential for innovation and job creation—this emphasis on software-driven innovation positions Australia for success in the AI industry.

Companies like Atlassian and Canva have already begun leveraging AI, and Australia’s strengths in specific industries (like agriculture and hospitality) provide fertile ground for AI innovation. Australia’s journey in AI has the potential to entirely reshape the nation’s technology landscape and economy. The companies that are AI-first in their approach are particularly exciting, ushering in a promising era of innovation and growth in the Australian tech sector.

Ryan Black and Grant McCarthy in conversation

So whether you are a technology founder developing a product or an investor seeking to allocate capital, it’s imperative to consider how AI can substantially enhance products, services, and customer experience. Drawing on an impressive track record of investing in AI-based venture opportunities, Tidal Ventures is well-positioned to consistently identify and champion innovative ventures at the forefront of the AI revolution. Our unwavering confidence in the burgeoning technology landscape means we’re continually uncovering compelling opportunities within both the model and application layers.

We love nothing more than engaging on these topics within the broader business, investment, and technology communities. We believe that these discussions, debates and collaborations lead to some of the most exciting opportunities, so if there is something you’d like to discuss, please don’t be shy and reach out.

Subscribe to Tidal Ventures

Get our latest newsletters delivered right to your inbox

Our recent thought waves

Investment Notes: Tendl

Tendl is a game-changing AI platform revolutionising how companies approach tendering by transforming complex bid processes into streamlined, intelligent workflows. What traditionally takes days can now be completed in under an hour, saving companies tens of thousands of dollars annually.

Investment Notes: Minikai

We're thrilled to have led Minikai's Seed round, partnering with the team to revolutionise how care providers operate in highly regulated sectors through AI-powered automation. As your AI ally in disability and aged care, their platform transforms the workflow of frontline care providers by automating administrative work and compliance reporting, enabling them to focus more time on patient care while building a powerful trust platform between regulators and providers.

Investment Notes: AIMon

We’re thrilled to announce that we’ve co-led AIMon’s Pre-Seed round alongside Bessemer Venture Partners. AIMon is addressing one of AI’s most pressing challenges: ensuring Large Language Models (LLMs) are safe, reliable, and enterprise-ready. Their platform empowers organisations to deploy AI confidently, mitigating risks like hallucinations, harmful content, and data leakage.