Investment Notes

Investment Notes: Checkbox

A great way to start 2022 — we co-led Checkbox’s pre-Series A round alongside Sequoia India’s Surge. We’re publishing notes detailing our investment thesis and why we think Checkbox is positioned to ride the no code expert automation wave.

28 Jan 2022 · 5 min read

Checkbox is a no code platform that enables non-technical business experts to build automated solutions that replace the manual tasks that bog down their day.

Checkbox combines forms automation, decisioning support, document automation, and workflow automation in a single platform to enable complete end-to-end Expert Process Automation (”EPA”) with a seamless end-user experience. EPA enables an organization to capitalize on the knowledge of its experts and build that into technology created by none other than those experts themselves. The automation of expert workflows is crucial to driving productivity gains within enterprises as no matter how repetitive and mundane the task, an expert’s knowledge is always required, drawing them away from the highest value-adding activities.

The team at Tidal tracked the business for nearly six months before the founders, Evan Wong and James Han, made the decision to raise a pre-Series A round with Tidal and Sequoia India's Surge. We spent that period white-boarding with Evan and James during monthly workshops that covered GTM, customer segmentation, and Series A tactics. We've been very impressed with the founders' responsiveness to advice, speed of execution, and ability to set and meet their forecasts.

Markets with Tailwinds

A crucial part of any investment process at Tidal is the ‘thesis development stage’. In fact, this often precedes an individual investment opportunity. As with most VCs, we want to invest behind markets with tailwinds. In other words, it’s important to get the timing right and to be able to answer the question “Why Now”.

A note on the No Code revolution

In the same way PCs democratized software usage, APIs democratized software connectivity and the cloud democratized the purchase and deployment of software. No Code will usher in the next wave of enterprise innovation by democratizing technical skillsets...this profound generational shift has the power to touch every software market and every user across the enterprise.

~ Techcrunch

We are in the midst of a No Code / Low Code movement, democratizing the ability to create software applications without the requirement to code. This removes internal bottlenecks caused by barriers to accessing IT and enables the business to address customer needs (through internal Dev & IT teams) without de-prioritizing internal productivity needs. The best part is that the creator of these internal automation tools is also the commercial expert, which has the benefit of producing the most relevant output as well as capturing a greater proportion of organizational IP within the tools themselves, therefore reducing the IP leakage that often comes with knowledge workers departing a company.

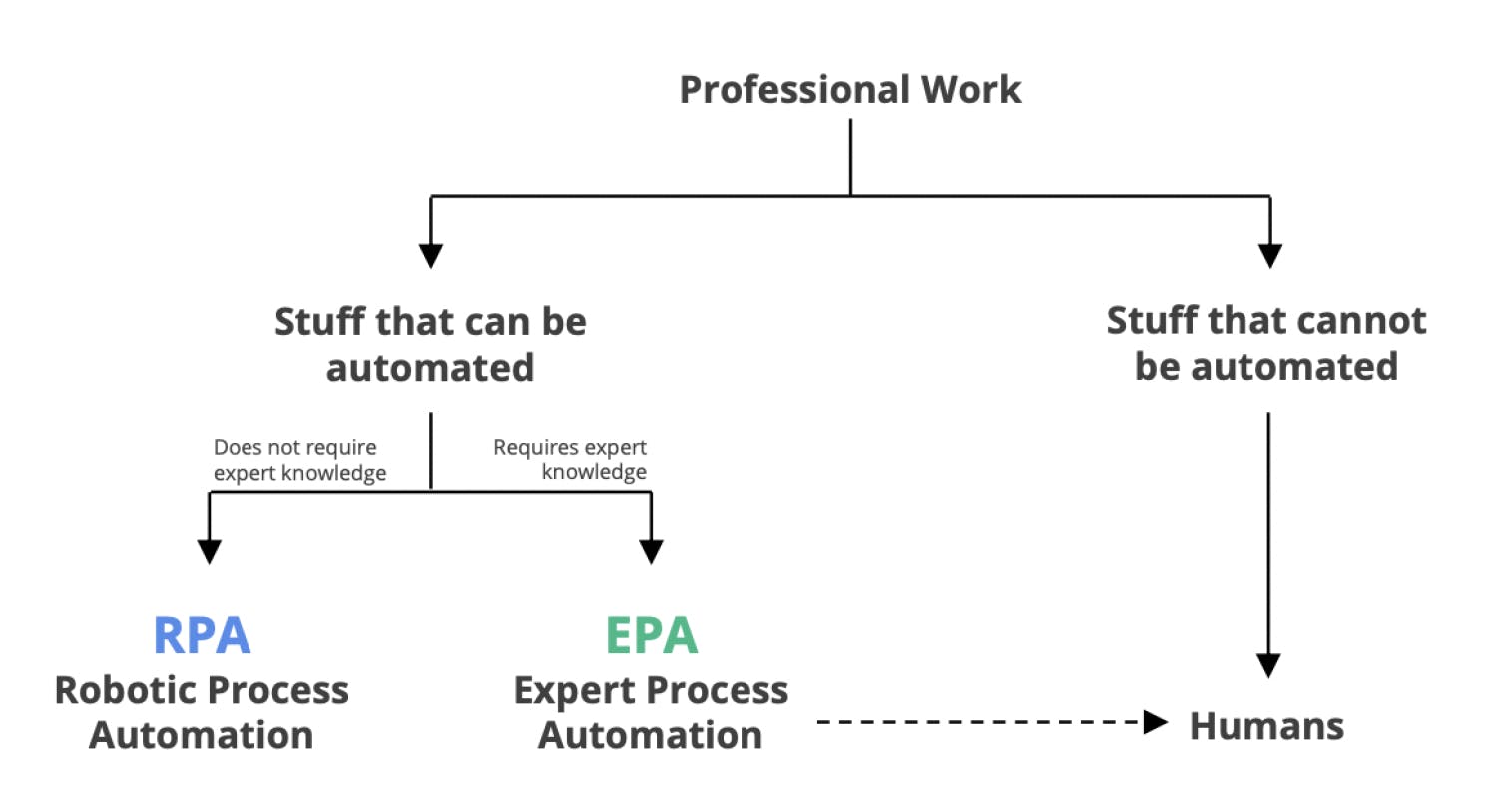

From RPA to EPA

Whilst often labelled as late adopters, enterprises have been turning to technology to drive efficiency gains for decades. In fact, it was estimated that enterprises spent USD 550 billion on custom software in 2021. The big shift we have seen in the past five years is towards automation. The first wave of enterprise automation is referred to as Robotic Process Automation (”RPA”), which automates individual tasks, removing them completely from the hands of humans. RPA saw a huge tailwind push during the pandemic, as companies sought to automate what was previously simplified by having people in the same office together. A leader in this space is UIPath, who were early to market in 2005 and IPO’d in 2021 as one of the largest US software IPOs in history (at that time, anyhow). Though it was the 12 months pre-pandemic when Gartner reported annual growth in RPA of sixty-three percent.

Next up was Business Process Automation, or BPA. This took RPA one step further by automating workflows and not just individual tasks. Human engagement was solicited through the process as and when required, but the workflow itself was overseen by the software. Technology is leveraged to perform a sequence of repetitive tasks where manual efforts are otherwise substituted. This market is estimated to reach $19.4 billion by 2026, up from $9.8 billion in 2020, growing at a CAGR of 12.2%.

And that brings us to Expert Process Automation, or EPA, what we believe is the next wave of the ‘no-code revolution’. EPA tackles problems that are higher up the value chain.

Unlike RPA, which is about replicating the exact actions a human user would take, EPA is about replicating the exact decisions and actions an expert would take.

Products that change the game

Enterprise teams need to automate manual work in order to drive much-needed productivity to remain competitive, but traditional software development software is typically not accessible or feasible (or incredibly expensive). Enterprises often turn to custom software to build out automation, which can address the specific needs of a business. However, each new solution has to play nice with legacy systems and processes and balance the competing interests of multiple internal teams, as well as be continually maintained over its lifespan. This doesn’t strike me as the most efficient option...

Enter Checkbox. Using drag and drop, expert knowledge workers can quickly and efficiently create and deploy software solutions that automate repeatable workflows. Internal IT resources are not required to unlock these new solutions (which can focus on the much higher value, customer-facing, needs) and the cost of Checkbox pales in comparison to leveraging third-party consultants.

We think Checkbox can be famous for enabling its users to quickly spin up a piece of software that automates some of their own workflows, striking that perfect balance between technical sophistication and ease of use.

This is game-changing for business users, who, without needing to code, can build an app that manages the information flow, decision making, and document generation required to automate their work. Checkbox's technology provides a full suite of enterprise-grade application development features on a single seamless interface, combined with rapid deployment, permission control, analytic dashboards, and integrations.

Founders that hustle

We first met Evan and James almost exactly one year ago — they are clear communicators, ambitious, capable, and very commercial. We witnessed firsthand their ability to articulate a vision for their business and consistently execute against it. We were most impressed with the strong ‘test and iterate’ culture they had cultivated and the speed and hustle with which they explored new growth levers. There were no excuses or delays when it came to testing out a new lever (on the GTM or product front), which enabled the team to make an informed decision around prioritization and value trade-offs.

Checkbox co-founders Evan Wong and James Han

A compelling business model

Checkbox is a SaaS business with attractive margins, excellent net revenue retention, and expanding ARR. Checkbox is well-positioned to engage in a dual-pronged GTM, with a genuine product-led growth engine complimenting enterprise sales efforts, especially as its reach expands through Tier 1 global partnerships.

We see strong potential for revenues to 'land and expand', with Checkbox generating incremental revenue the more apps their customers build (and the more value their customers derive from the platform). Checkbox has an existing blue-chip enterprise customer base (e.g. Coca-Cola, Telstra), largely landed through the legal department, with evidence of expansion across functions to People & Culture, Procurement, Finance, Risk, and IT. In addition to inter-company expansion (by department or function), Checkbox has already proven its ability to compete in the US having secured its first six-figure US customer in 2021.

The Seed Phase and beyond

Checkbox firmly checks the boxes (pun intended ;) for nearly all Seed Phase proof points despite having never raised a formal Seed round. We see this with companies, such as Checkbox, that demonstrate a strong product-market-fit from Day 1 and accelerate through the initial growth phase. Off the back of strong global momentum, the founders made the decision to raise a pre-Series A round that will position the company to tap into international markets for their next round of capital.

For a refresher on how we view the Seed Phase, please read our blog on this topic. The company has a product that customers love, a repeatable GTM strategy, a clear land product, and well-understood metrics. Leading up to the round, the company had proven its ability to compete with global incumbents and secure international customers. We see a huge opportunity ahead, especially as the team leverages global distribution partners, to further tap into international markets from both a customer acquisition and investment perspective.

We look forward to supporting Evan, James, and the Checkbox team as they continue to help business users automate their work, and grow Checkbox into international markets.

If you're a visionary founder who is ready to make waves, please reach out via our website.

Subscribe to Tidal Ventures

Get our latest newsletters delivered right to your inbox

Our recent thought waves

Investment Notes: Tendl

Tendl is a game-changing AI platform revolutionising how companies approach tendering by transforming complex bid processes into streamlined, intelligent workflows. What traditionally takes days can now be completed in under an hour, saving companies tens of thousands of dollars annually.

Investment Notes: Minikai

We're thrilled to have led Minikai's Seed round, partnering with the team to revolutionise how care providers operate in highly regulated sectors through AI-powered automation. As your AI ally in disability and aged care, their platform transforms the workflow of frontline care providers by automating administrative work and compliance reporting, enabling them to focus more time on patient care while building a powerful trust platform between regulators and providers.

Investment Notes: AIMon

We’re thrilled to announce that we’ve co-led AIMon’s Pre-Seed round alongside Bessemer Venture Partners. AIMon is addressing one of AI’s most pressing challenges: ensuring Large Language Models (LLMs) are safe, reliable, and enterprise-ready. Their platform empowers organisations to deploy AI confidently, mitigating risks like hallucinations, harmful content, and data leakage.