Investment Notes

Investment Notes: Loopit

We are delighted to have led Loopit’s Seed round. Loopit is a software provider that enables mobility companies to introduce vehicle subscription offerings to their own customers.

27 Jun 2022 · 4 min read

Loopit’s mobility platform drives car subscription management and billing solutions for automakers, dealerships, fleet leasing, rental companies and startups.

The Tidal team recently made an investment into Loopit, and we're publishing our investment notes below. We invest across a range of markets, models and products. There are core principles that we live and die by in our investment decisions. For more information on the pillars that make a great Tidal Seed Investment, see how we invest here.

Markets with Tailwinds

With the transformation to cloud, consumers and businesses alike are consuming software online using subscription as the standard arrangement. This transformation is occurring across many other industries, and the automative industry is undergoing its own digital transformation that is set to change the way:

- consumers or businesses interact with car brands (e.g. Care by Volvo)

- consumers obtain the vehicle (e.g. subscribe to an EV through your energy provider)

- consumers experience the entire lifecycle of acquiring, running, managing, and selling a vehicle (e.g. subscribe to a car, maintained by the vendor, only fill fuel, return it when done or swap they vehicle if the plan allows it)

We believe that there is a compelling case emerging for the growth of car subscriptions as a viable alternative to long term rental, leasing, and ownership in many cases.

This transition is aligned with changing consumer behaviour that seeks greater flexibility and convenience around mobility. There is waning interest in owning physical products, particularly among younger generations; hybrid and remote work is changing the way cars are used, and climate consciousness and improving infrastructure are driving a shift to electric vehicles. In addition to being highly flexible, vehicle subscription programs are also perceived as being more cost-effective than traditional car leases, rentals, or outright purchases. The experience of buying and selling a car can be tedious, and, factoring in on-road costs, registration, taxes, servicing, and depreciation, the total cost of ownership is often under-estimated by more than 50%.

In parallel, the auto industry is undergoing its own transformation. Tesla has led the way, disrupting the industry through both its car and its go-to-market approach. Newer micro-mobility categories (e.g. e-bikes, scooters) were born online and have been early adopters of a subscription model, and now the traditional car industry more broadly is transitioning to online retail, which will emphases personalisation and better customer communication.

We expect the subscription market to continue to grow at pace through improvements in price competitiveness, the customer experience, and consumer awareness. According to market research, the current vehicle subscription market is US$4.1B and will grow at 22.8% CAGR to 2030 to a market size of +$31.7B. Over the next eight years, BCG estimates that up to 15% of new car sales will be via a subscription.

Products that change the game

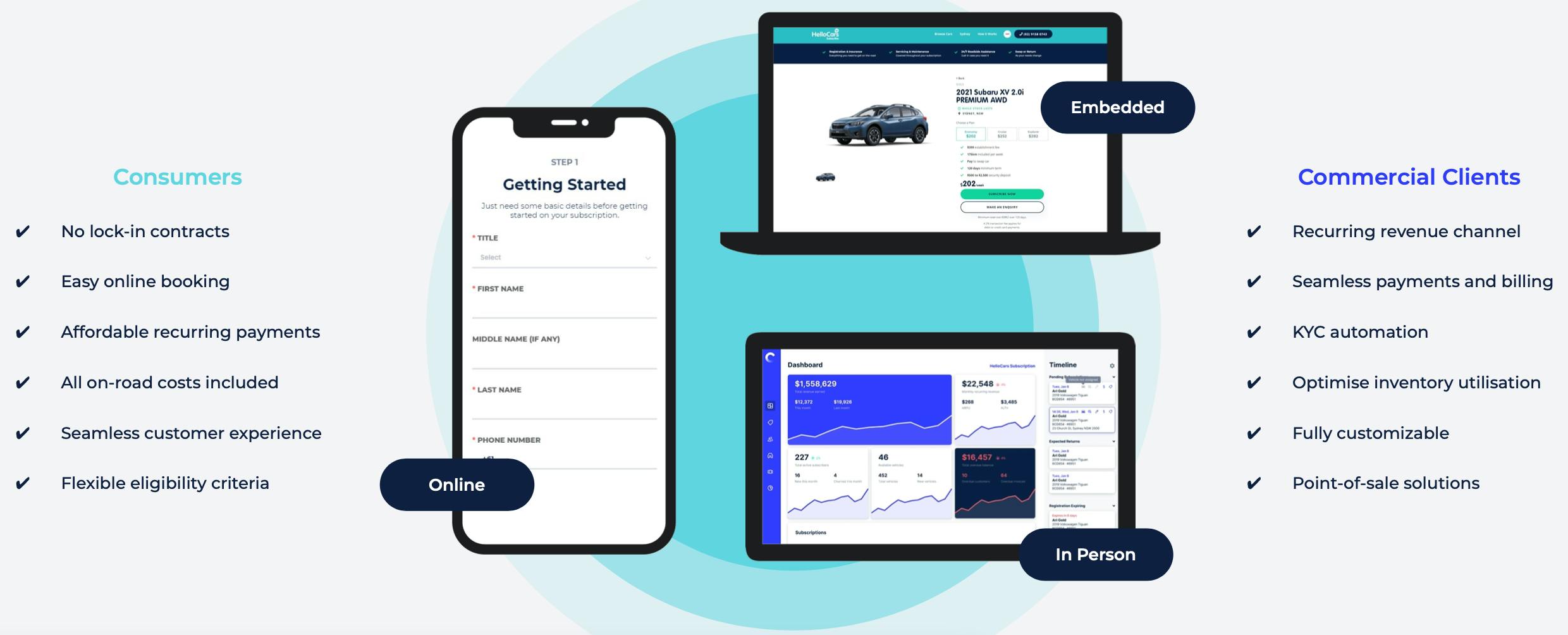

Loopit provides a turnkey subscription management solution that helps automakers, car dealerships, fleet rental companies and startups to introduce car subscription offerings to their own customers.

Loopit’s SaaS platform facilitates the end-to-end subscription process, providing mobility companies with the ability to control, configure, and provide a subscription offering quickly and easily. The platform handles the customer-facing touchpoints such as onboarding, billing, and ongoing customer management, as well as back-office management features such as management of inventory, pricing, and utilisation.

This is game changing for both new entrants who wish to get to market quickly, and existing automotive players who largely run their businesses on legacy platforms that are tailored to other customer models.

Loopit not only powers the shift to subscriptions, they improve the overall customer experience, back office management and economics through software.

Loopit consolidates up to 12 different standalone software platforms into one cohesive, purpose-built mobility solution.

Founders that Hustle

Co-founders (and brothers) Michael and Paul Higgins have lived their customers’ problems and built the industry-leading solution to solve it. They initially built Loopit’s software to support their car subscription marketplace HelloCars, before realising the opportunity to provide it more broadly across the mobility industry.

Michael, Paul, and the broader management team combine both strong functional capabilities in building a software business with extensive domain knowledge in the automotive industry. They have demonstrated strong execution, building a healthy and scalable business that has won several key automotive brands as clients and expanded globally prior to any venture backing.

Loopit Founders Paul (LHS) and Michael Higgins

A compelling business model

Loopit have built out an attractive business model and demonstrated strong unit economics. They earn both a subscription fee for ongoing use of the platform, as well as consumption revenues through a clip applied to the underlying subscription payment of the end consumers.

Over time, we see the opportunity for continued growth through expansion into new markets, and further influencing the economics and experience of car subscriptions through the product. With critical mass they can obtain an unfair data advantage with access to inventory, pricing intelligence and a future opportunity to launch their own aggregation play via a marketplace.

The Seed Phase and beyond

Loopit is in its Seed Phase. It has demonstrated strong product-market fit and built out a highly capable team, having bootstrapped the business to date. This round is intended to support with global expansion and implementing a more scalable and repeatable go-to-market approach. We see significant opportunity to ramp up growth efforts with product and sales / marketing activities in harmony, providing customers with different maturity levels with the opportunity to either self-serve, or to localise and tailor their offering with a higher degree of support.

We look forward to continuing to support the Loopit team as they enable the transition to car subscription models.

Thanks to Max Kausman for help in drafting this post.

If you're a visionary founder who is ready to make waves, please reach out via our website.

Subscribe to Tidal Ventures

Get our latest newsletters delivered right to your inbox

Our recent thought waves

Investment Notes: Tendl

Tendl is a game-changing AI platform revolutionising how companies approach tendering by transforming complex bid processes into streamlined, intelligent workflows. What traditionally takes days can now be completed in under an hour, saving companies tens of thousands of dollars annually.

Investment Notes: Minikai

We're thrilled to have led Minikai's Seed round, partnering with the team to revolutionise how care providers operate in highly regulated sectors through AI-powered automation. As your AI ally in disability and aged care, their platform transforms the workflow of frontline care providers by automating administrative work and compliance reporting, enabling them to focus more time on patient care while building a powerful trust platform between regulators and providers.

Investment Notes: AIMon

We’re thrilled to announce that we’ve co-led AIMon’s Pre-Seed round alongside Bessemer Venture Partners. AIMon is addressing one of AI’s most pressing challenges: ensuring Large Language Models (LLMs) are safe, reliable, and enterprise-ready. Their platform empowers organisations to deploy AI confidently, mitigating risks like hallucinations, harmful content, and data leakage.